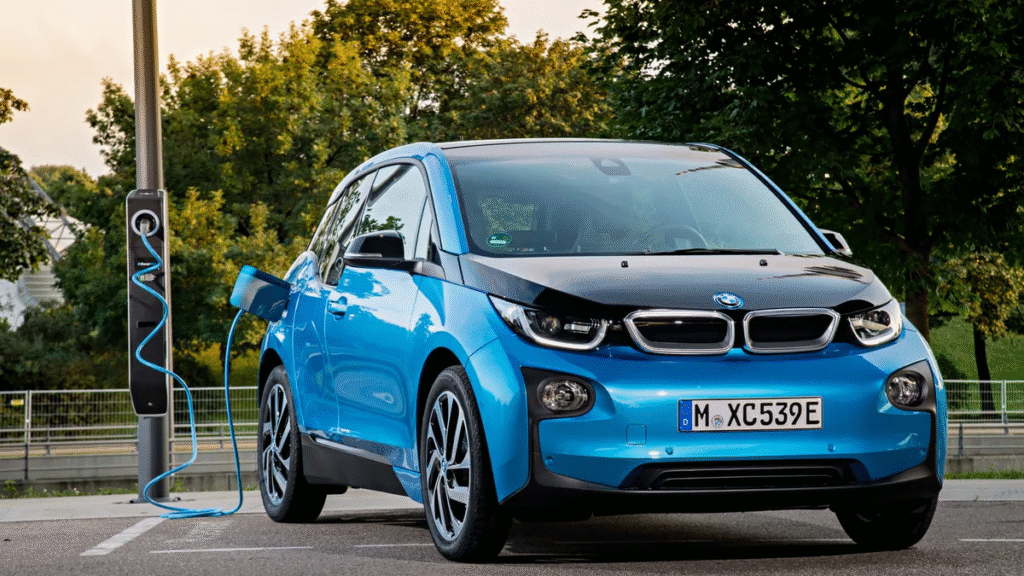

Electric Car Insurance USA Electric vehicles (EVs) are zooming into the mainstream, with sleek designs and eco-friendly promises. But for Tesla owners in the USA, there’s a hidden cost that’s sparking conversations: insurance premiums. In 2025, insuring a Tesla can cost up to 70% more than the national average for other vehicles, adding an extra $1,900–$2,000 annually to owners’ budgets. Why do Tesla drivers face such steep rates? Let’s dive into the factors driving these costs, share some real-life stories, and offer tips to help you navigate the electric car insurance landscape.

What Makes Electric Car Insurance Different?

The Rise of EVs in the USA

Electric vehicles are no longer a futuristic dream. By 2025, over 20% of new car sales in the USA are projected to be EVs, with Tesla leading the pack. Models like the Tesla Model 3, Model Y, and Cybertruck dominate roads with their cutting-edge tech and performance. But with great innovation comes a unique insurance challenge.

Why Insurance Costs Vary for EVs

Insuring an EV isn’t the same as insuring a gas-powered car. EVs have complex battery systems, advanced driver-assistance features, and higher repair costs. These factors make insurers raise their eyebrows—and their rates. For Tesla owners, the stakes are even higher due to the brand’s proprietary technology and premium price tag.

Why Tesla Owners Pay More for Insurance

High Repair Costs: The Tesla Premium

Tesla vehicles are engineering marvels, but that comes at a price. The average repair cost for a Tesla Model 3 is around $1,500–$2,000 more than for a comparable gas-powered sedan. Why? Tesla’s aluminum frames, specialized parts, and limited repair networks mean fewer shops can handle fixes, and those that can charge a premium. For example, replacing a Tesla battery can cost $15,000–$20,000, a figure that makes insurers nervous.

Real-Life Example: Sarah’s Fender Bender

Sarah, a 35-year-old Tesla Model Y owner from California, learned this the hard way. After a minor fender bender in 2024, her repair bill hit $8,000 due to a damaged sensor in the car’s Autopilot system. Her insurer, citing Tesla’s high repair costs, increased her premium by 25% at renewal. Stories like Sarah’s are common, as posts on X highlight Tesla owners feeling the sting of elevated repair expenses.

Battery Damage and Totaling Risks

Tesla’s battery packs are the heart of their vehicles—and a major headache for insurers. Even minor accidents can lead to battery damage, which often results in the car being totaled. According to industry data, EVs, particularly Teslas, are totaled 20% more often than gas-powered cars because battery repairs are so costly. This risk pushes insurers to charge higher premiums to cover potential payouts.

Expert Insight: The Battery Cost Conundrum

Dr. Emily Chen, an automotive insurance analyst, explains, “Insurers see Tesla’s battery as a high-risk component. A single accident could lead to a $20,000 claim, so they price policies to reflect that exposure.” This explains why Tesla owners like John, a 42-year-old from Texas, saw his insurance quote for a Model S jump to $3,200 annually—nearly double the national average of $1,700.

Proprietary Tech and Limited Repair Networks

Tesla’s cutting-edge features, like Autopilot and Full Self-Driving (FSD), are game-changers, but they complicate repairs. Sensors, cameras, and software recalibrations require specialized technicians, and Tesla tightly controls its repair ecosystem. Only certified Tesla repair shops can access proprietary parts, driving up costs. In 2025, only about 300 Tesla-certified repair facilities exist in the USA, compared to over 20,000 general auto shops.

Case Study: Mark’s Repair Nightmare

Mark, a Tesla Model X owner in Florida, waited three months for a certified repair shop to fix his car’s falcon-wing door after a parking lot scrape. The delay and $12,000 repair bill led his insurer to hike his premium by 30%. “It felt like I was paying for Tesla’s exclusivity,” Mark shared on X, echoing a sentiment among owners facing long wait times and high costs.

Higher Vehicle Value Means Higher Premiums

Teslas aren’t cheap. The average price of a Tesla Model Y in 2025 is around $65,000, compared to $40,000 for a typical gas-powered SUV. Insurers base premiums partly on vehicle value, as replacing or repairing a high-end car costs more. This makes Tesla insurance pricier, even for models like the Model 3, which starts at $45,000.

Driving Behavior and Tesla’s Performance Appeal

Teslas are fast—really fast. The Model S Plaid can hit 0–60 mph in under two seconds, attracting drivers who love performance. Insurers often view high-performance vehicles as riskier, associating them with speeding or aggressive driving. Data from the Insurance Institute for Highway Safety shows that sports cars and high-performance EVs have 15% higher claim rates than standard vehicles.

Real-Life Example: Jake’s Speedy Surprise

Jake, a 29-year-old Model 3 owner in Nevada, admits he loves testing his car’s acceleration. After a speeding ticket in 2024, his insurance premium spiked to $2,800 annually. “I didn’t realize my driving habits would hit my wallet so hard,” he said. Insurers use telematics data from Tesla’s onboard systems to monitor driving behavior, which can further increase rates for thrill-seekers.

The Role of Insurance Companies in 2025

How Insurers Calculate EV Premiums

Insurance companies use a mix of factors to set rates: vehicle type, repair costs, driver profile, and claim history. For EVs, they also consider battery replacement costs, accident frequency, and theft rates. Teslas, with their high-tech components and premium status, check all the boxes for higher risk in insurers’ eyes.

Featured Snippet: Factors Driving Tesla Insurance Costs

- High repair costs: Specialized parts and limited repair shops increase expenses.

- Battery risks: Damage often leads to totaling the vehicle.

- Proprietary tech: Autopilot and FSD require costly recalibrations.

- Vehicle value: Higher MSRP means higher replacement costs.

- Driving behavior: Performance models attract riskier drivers.

Tesla Insurance: A Game-Changer?

Tesla offers its own insurance in select states, using real-time driving data to set rates. In 2025, Tesla Insurance is available in 12 states, including California and Texas, and claims to save owners up to 20% compared to traditional insurers. However, it’s not a cure-all. Some owners report mixed experiences, with savings offset by strict driving behavior monitoring.

Expert Insight: Tesla’s Data-Driven Approach

“Tesla Insurance leverages the car’s telematics to reward safe drivers,” says Michael Barry, spokesperson for the Insurance Information Institute. “But it’s not for everyone. If you drive aggressively or live in a high-risk area, you might not see savings.” This explains why some Tesla owners on X praise the program, while others feel it’s too intrusive.

Comparing Tesla Insurance to Other EVs

Tesla vs. Other Electric Vehicles

While all EVs face higher insurance costs, Teslas stand out. For example, insuring a Ford Mustang Mach-E averages $1,900 annually, while a Tesla Model Y costs $2,600–$3,000. The gap comes down to Tesla’s premium branding, complex tech, and repair challenges. Data from a 2025 Bankrate study shows Tesla models are 30–40% more expensive to insure than other EVs like the Rivian R1T or Hyundai Ioniq 5.

Why Other EVs Cost Less

Other EV manufacturers use more standardized parts and have broader repair networks. For instance, the Chevrolet Bolt EV, priced at $35,000, has repair costs closer to traditional cars, keeping insurance premiums lower. Tesla’s closed ecosystem, while innovative, creates a bottleneck that drives up costs.

How Tesla Owners Can Save on Insurance

Shop Around for Quotes

Don’t settle for the first quote. Comparing rates from providers like Geico, Progressive, and State Farm can save you hundreds. In 2025, online tools like The Zebra or Insurify make it easy to compare EV-specific policies. Sarah, the Model Y owner, saved $600 annually by switching to a provider with better EV coverage.

Bundle Your Policies

Bundling auto and home insurance can cut premiums by 10–20%. Many insurers offer discounts for multi-policy holders, which can offset Tesla’s high rates. Mark, the Model X owner, bundled his policies and shaved $400 off his annual premium.

Leverage Tesla Insurance (If Available)

If you’re in a state where Tesla Insurance is offered, get a quote. It’s tailored to Tesla vehicles and may offer savings for safe drivers. Just be ready for real-time monitoring, which tracks your driving habits via the car’s sensors.

Improve Your Driving Habits

Safe driving pays off. Avoiding speeding tickets and accidents can keep your premiums in check. Jake, after his costly ticket, enrolled in a defensive driving course, which lowered his rate by 15%. Many insurers offer discounts for completing such courses.

Increase Your Deductible

Raising your deductible from $500 to $1,000 can lower your premium by 10–15%. Just ensure you have enough savings to cover the higher out-of-pocket cost in case of a claim.

Featured Snippet: Tips to Save on Tesla Insurance

- Compare quotes: Use tools like The Zebra to find the best rates.

- Bundle policies: Combine auto and home insurance for discounts.

- Try Tesla Insurance: Available in select states, it may save up to 20%.

- Drive safely: Avoid tickets and accidents to keep rates low.

- Raise deductibles: A higher deductible reduces your premium.

The Future of Electric Car Insurance in 2025 and Beyond

Trends Shaping EV Insurance

As EVs become more common, insurers are adapting. By 2026, experts predict more companies will offer EV-specific policies, potentially lowering rates. Advances in repair technology, like modular battery designs, could also reduce costs. However, Tesla’s premium status may keep its insurance prices elevated.

Tesla’s Push for Affordability

Tesla is working to address high insurance costs. In 2025, the company is expanding its insurance program and investing in repair network growth. Elon Musk has hinted at future plans to streamline repairs, which could ease the burden on owners.

The Role of Regulation

State regulations also play a part. California and New York, with strict EV mandates, are pushing insurers to offer competitive rates. As more states adopt similar policies, Tesla owners may see relief in the coming years.

FAQs About Tesla Insurance in 2025

Why is Tesla insurance so expensive?

Tesla insurance is costly due to high repair costs, expensive battery replacements, proprietary technology, and the brand’s premium vehicle value. Insurers also factor in the performance capabilities of Tesla models, which can lead to riskier driving behavior.

Can I get cheaper insurance for my Tesla?

Yes! Shop around for quotes, bundle policies, consider Tesla Insurance, drive safely, and raise your deductible to lower premiums. Comparing rates from multiple providers is key.

Does Tesla Insurance save money?

Tesla Insurance can save up to 20% for safe drivers in states where it’s available. However, savings depend on your driving habits and location, as the program uses real-time telematics data.

Are other EVs cheaper to insure than Teslas?

Generally, yes. EVs like the Ford Mustang Mach-E or Chevrolet Bolt have lower insurance costs due to standardized parts and broader repair networks, averaging 30–40% less than Tesla models.

Conclusion: Navigating Tesla Insurance in 2025

Owning a Tesla is a thrilling experience, but the insurance costs can be a shock. High repair prices, battery risks, and proprietary tech make Tesla one of the priciest vehicles to insure in 2025. Yet, with smart strategies—comparing quotes, bundling policies, or exploring Tesla Insurance—you can ease the burden. As the EV market grows and Tesla expands its repair and insurance offerings, there’s hope for more affordable coverage in the future. For now, arm yourself with knowledge, drive safely, and shop wisely to keep your Tesla dream from becoming a financial nightmare.